Live Tracking & Field Reports

Track your team live and get instant field reports

Geo Attendance Tagging

GPS-based check-ins for accurate attendance

Real-Time Task Updates

Instant updates to keep tasks on track

Set Sales Targets

Set goals and track progress in real time

Efficient KPI Management

From Goals to Growth – Effortless KPI Monitoring

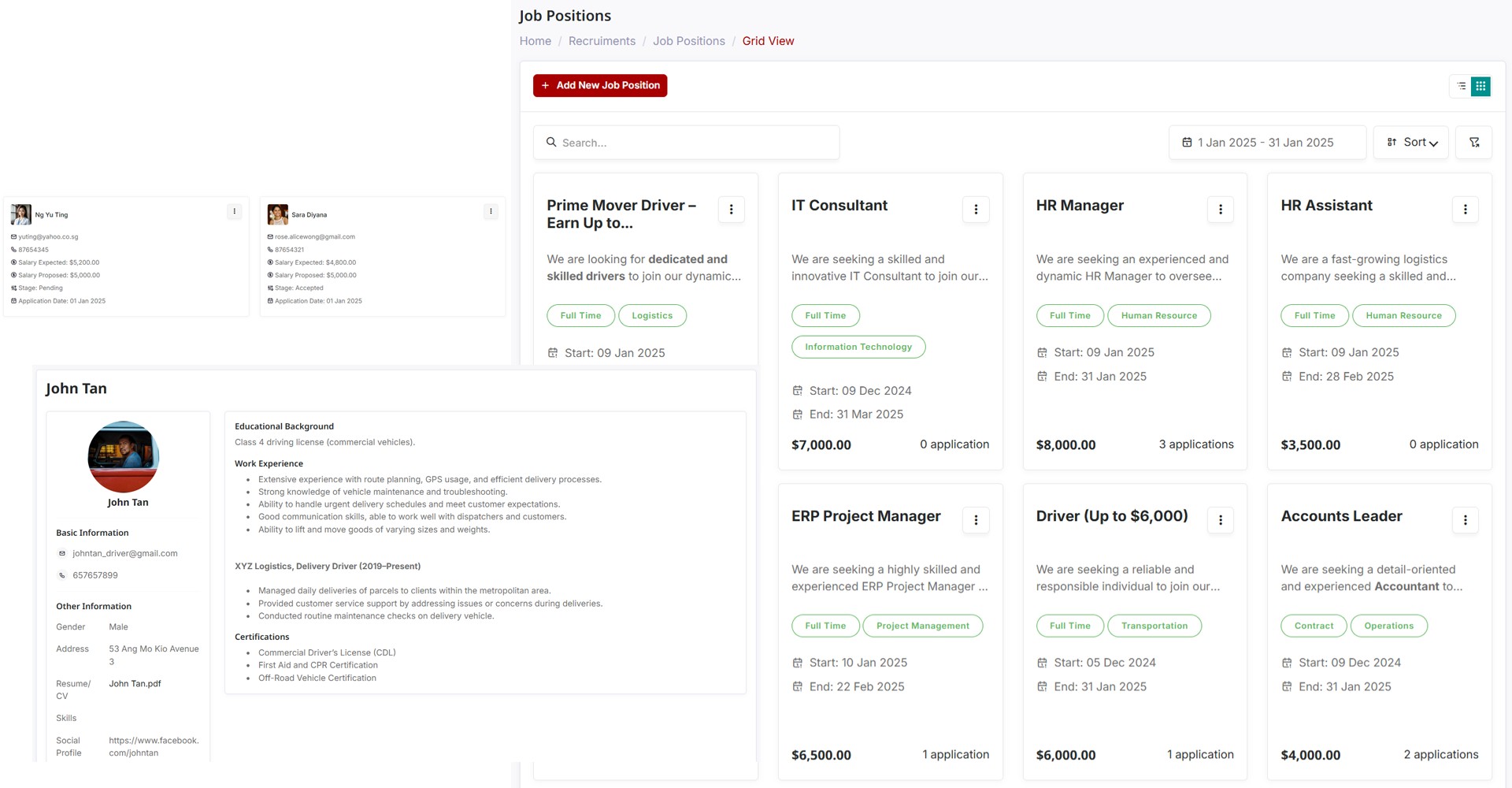

Employee Management with AI

Claims, Deductions, Solutions – with AI Precision

Workflow Management

Optimize, Automate, Outperform with Smarter Workflows

CRM Integration

Connect, Convert, Close – CRM & HRMS Integration

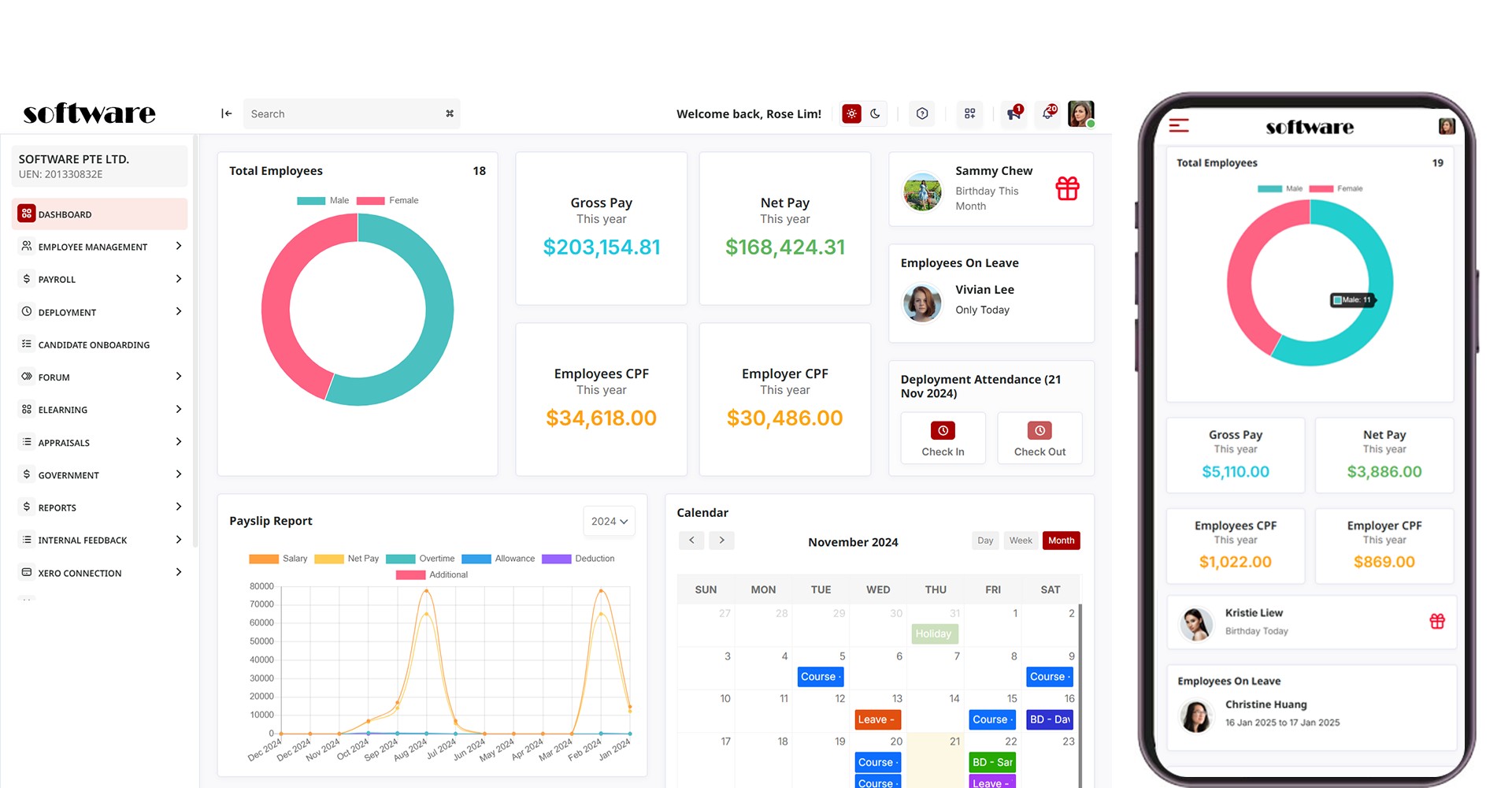

Payroll

Data Compilation from Leave, Attendance, etc.

-

Enjoy integrated workflows for cloud-based HR and payroll.

-

Get automatic calculations based on employee records from other modules like Claims, and prorate salaries & allowances with ease.

Automatic CPF, FUND, SDL Calculations

-

Use a constantly updated, IRAS-listed vendor payroll system software in Singapore.

-

Stay aligned with changing policies, taxation formats, rates, and more.

One-click AIS submission

-

Make AIS submissions directly to IRAS via HRM.sg engine.

Highly Customisable, Flexible System to Suit Your Business

-

Customise payroll processes as needed and configure employee-specific payroll components such as basic salary, allowances, deductions etc.

-

Set up multiple payroll schedules so you can run multiple payrolls based on your business requirements.

Bank Giro Transfer, Linking, and File Creation

-

Link to Singapore’s banks and create records with ease.

-

Generate multiple bank files for multiple payouts from different bank accounts so you can manage online bank transfers for payroll faster than ever.

Third-Party App Integrations

-

Make the app fit your preferred workflow and setup with third-party integrations for apps like Xero, Quickbooks, and more.

Automated Tax filing for IR8A and more

-

Get rid of manual income tax form filing with our HRMS system that generates IR8A, IR21, IR8S and appendix A for you.

Easy Access for Employees Anytime, Anywhere

-

Send employees notifications for payslips via the app.

-

View and download payslips from mobile app, email, and web, with payslips itemised as per MOM guidelines.

API integration with MOM

-

Submit your OED to MOM seamlessly without any hassle from our system

Pricing

CTC Grant (70%) for Singapore Entities.

Drive your SME forward with advanced tech tools designed to simplify processes, enhance customer experiences, and maximize profits.

Transform your Business and Upskill your Workers.

What is the NTUC CTC Grant?

The grant is managed by NTUC’s e2i (Employment and Employability Institute) to support entities that have formed Company Training Committees (CTC) to implement transformation plans that would lead to better worker and business outcomes.

Who can apply for the CTC Grant?

Entities legally registered or incorporated in Singapore i.e. companies, societies, non-profit organisations such as charities and social service agencies are welcome to apply.

1 Government bodies, statutory boards, organs of state, and wholly-owned subsidiaries of Government are not eligible.

What is the funding support for eligible entities?

The CTC Grant provides funding support of up to 70% of qualifying cost for each project.

Funding quantum will be assessed based on:

Strength of project from business transformation perspective

Cost of project from worker outcomes perspective

What can be supported under the grant?

Items must be deemed relevant and tied to transformation plans that lead to worker and business outcomes. Examples of supportable items:

Equipment/Software and related OEM/software training

Consultancy

What is the objective?

The grant serves to strengthen worker and business outcomes to bring about:

Enterprise transformation: Enhanced business capabilities, innovation and/or productivity;

and

Workforce transformation: Better career prospects and better wages for local workers (Singapore Citizens / Singapore Permanent Residents) through efforts such as job redesign. Applicant to commit at least 1 of following worker outcomes:

-

wage increase; and/or

implemented Career Development Plan (CDP) that is communicated to staff.

Advanced HRMS

Partnership Programme

Welcome to our Partner Programme, designed to reward you generously for promoting and selling our software and business solutions. With commission rates as high as 50% for standard packages and 25% for bespoke solutions, our programme offers lucrative opportunities for your efforts and dedication.

Contact Us

Let’s Start a Conversation

Have questions or need support? Connect with us today:

- support@hrm.sg

- Operating Hours: Monday Friday (10am-6pm) – Excluding Public Holidays

Or fill out our contact form, and our team will be in touch promptly. Let’s build your success together!